in 6 Continents and 20 Countries

** TSPB 2018, 2020, 2021 Awards

Expanding With Liaison Offices

18 Ülkede Yatırıma Yön Veren

En Hızlı Büyüyen**

Şirketi

**SBP 2018, 2020, 2021 Ödülleri

We derive our strength from our independence...

At Azimut Portföy, we draw our strength from our independence because our only business is portfolio management. We do not have activities in different fields such as banking and insurance. This allows us to spend more time with our customers, getting to know each of them individually and understanding their expectations, enabling us to offer a suitable investment plan.”

Murat Salar

General Manager, Azimut Portföy

Management

** TSPB 2018, 2020, 2021 Awards

Funds

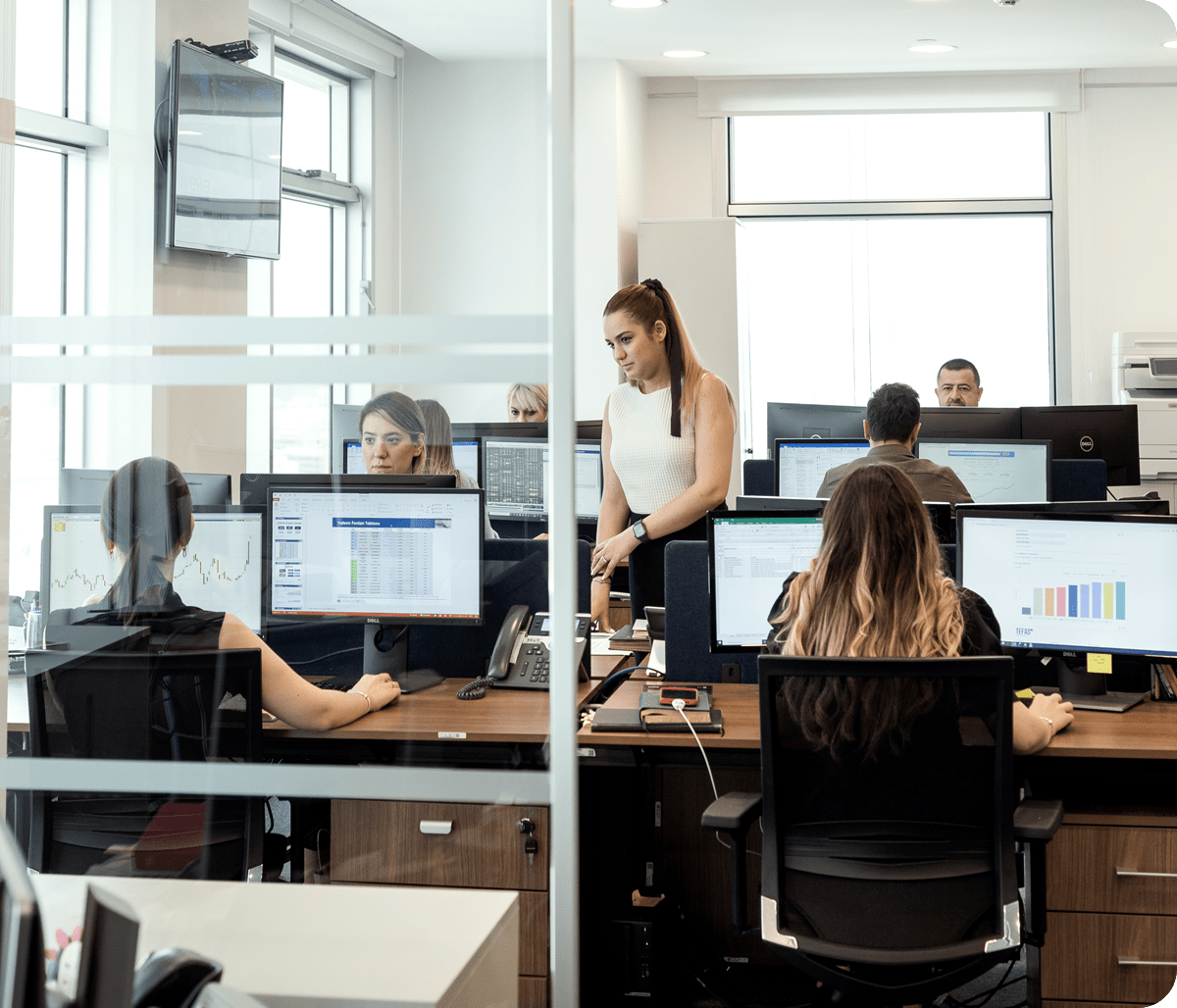

We Are Expanding with Our Liaison Offices

Türkiye’nin irtibat bürolarıyla genişleyen ilk portföy yönetim şirketi olarak her geçen gün size daha çok yaklaşıyoruz.

Investment Solutions

Support from Over 150 Global Fund Managers

Investment Funds

Individual Portfolio Management

While you focus on your work, family, and social life, we manage your savings according to the goals and strategies we have jointly determined.

Your Money Is Always Secure

Control, audit, reporting and storage services for your assets are carried out by İş Bankası.

Our Investment Funds Suitable for Different Investor Profiles

Conservative

Funds

Investment funds that may be suitable for investors who do not prefer to take risks and want to obtain reasonable returns without risking their principal, such as alternative to deposit, fixed income and low-risk investment funds.Fonları göster

Conservative Balanced

Funds

Investment funds that may be suitable for investors who accept a reasonable volatility in their investments in line with their risk/return expectations and prefer to take measured and yield-oriented risks to achieve balanced returns.

Fonları göster

Balanced

Funds

Investment funds that may be suitable for investors who accept medium volatility in their investments in line with their risk/return expectations, take measured and yield-oriented risks to achieve balanced returns, and prefer medium- and high-risk investment funds.

Fonları göster

Balanced Aggressive

Funds

They consist of a combination of volatile products and balancing products. Investment funds that may be suitable for investors who aim to protect themselves against inflation by taking certain risks. Balanced Aggressive funds offer high return targets in exchange for increased volatility.

Aggressive

Funds

Investment funds that may be suitable for investors who can tolerate high volatility values in their investments and target high potential profit margins, such as bond-weighted funds, gold, commodities, foreign exchange and foreign equities funds.

Fonları göster